Introduction – What is OnlyFans? OnlyFans, launched in 2016, is a subscription-based platform allo...

Tag Archives: CANADIAN ACCOUNTING & TAX BLOGS

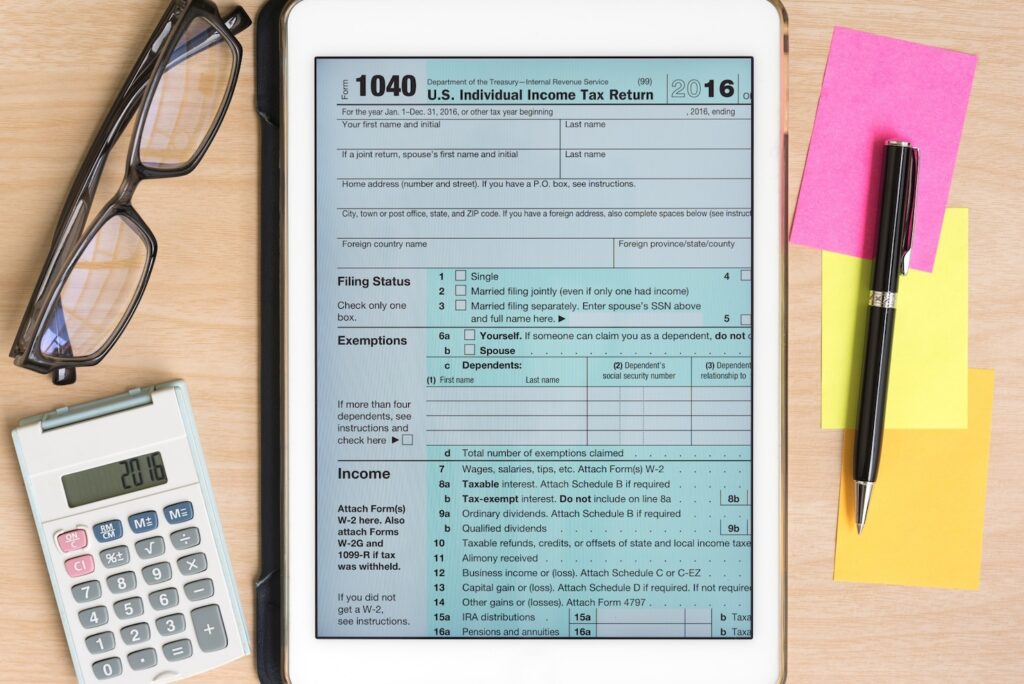

Introduction Starting a business is an exciting endeavor, but it comes with significant legal and ta...

Introduction: Benefits of CCPC Status A Canadian Controlled Private Corporation (CCPC) enjoys severa...

Introduction – What is a Real Estate Assignment? In the Canadian real estate market, assignments a...

Introduction: Understanding Deduction of Employment-Related Legal Expenses Canadian employees are ge...

Introduction: The Distinction Between Independent Contractors and Employees In Canada, the distincti...

Introduction: Navigating Tax Complexities in Family Law While family law predominantly focuses on th...

Introduction – Employment Expenses as a Condition of Employment While businesses and self-employed...

Introduction Managing rental properties can be rewarding, but it also comes with significant respons...

Introduction Understanding Canada’s tax system is essential for financial planning. Many Canadians...