Introduction When it comes to saving for major milestones like buying a home, Canadians have several...

Tag Archives: All

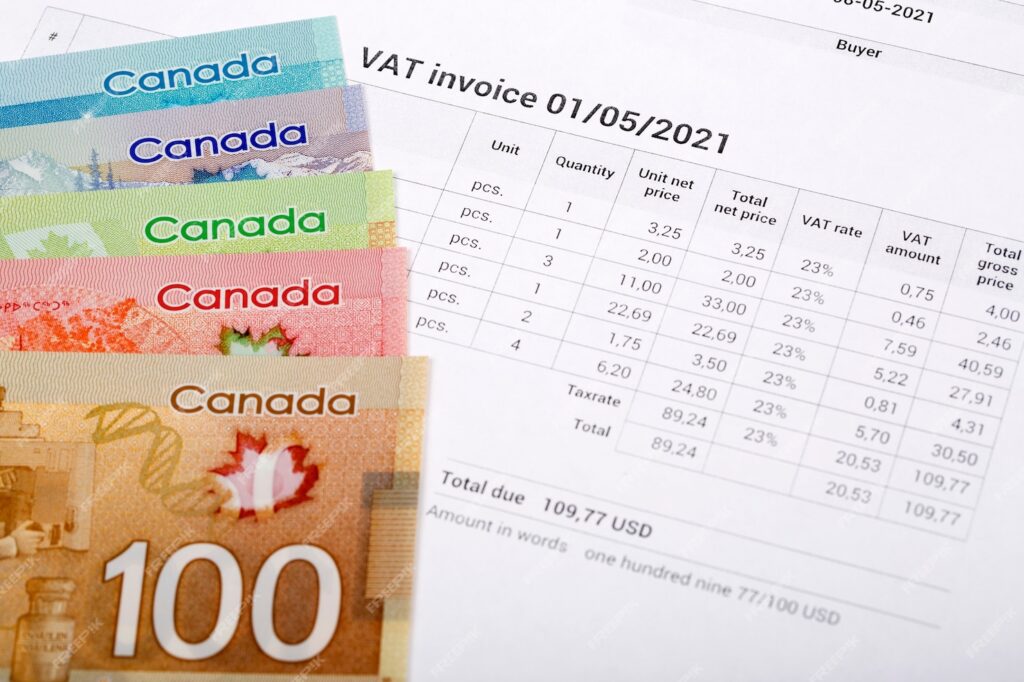

Introduction Paying taxes is an inevitable part of life, but understanding and utilizing tax strateg...

Introduction As your wealth grows, so do the complexities of managing it effectively, particularly w...

Introduction The federal government's Home Buyers' Plan (HBP) is a program designed to assist first-...

Introduction Guaranteed Investment Certificates (GICs) have become a popular choice among Canadian i...

Introduction A recent study by IG Wealth Management’s Financial Confidence Index reveals that Cana...

Introduction A Registered Retirement Savings Plan (RRSP) is a tax-advantaged savings account designe...

Introduction The First Home Savings Account (FHSA), launched in April 2023, is quickly becoming a go...

Introduction In Canada’s increasingly competitive real estate market, prospective homebuyers face ...

Introduction The dream of owning a cottage or cabin remains strong for many Canadians, with 59% of p...